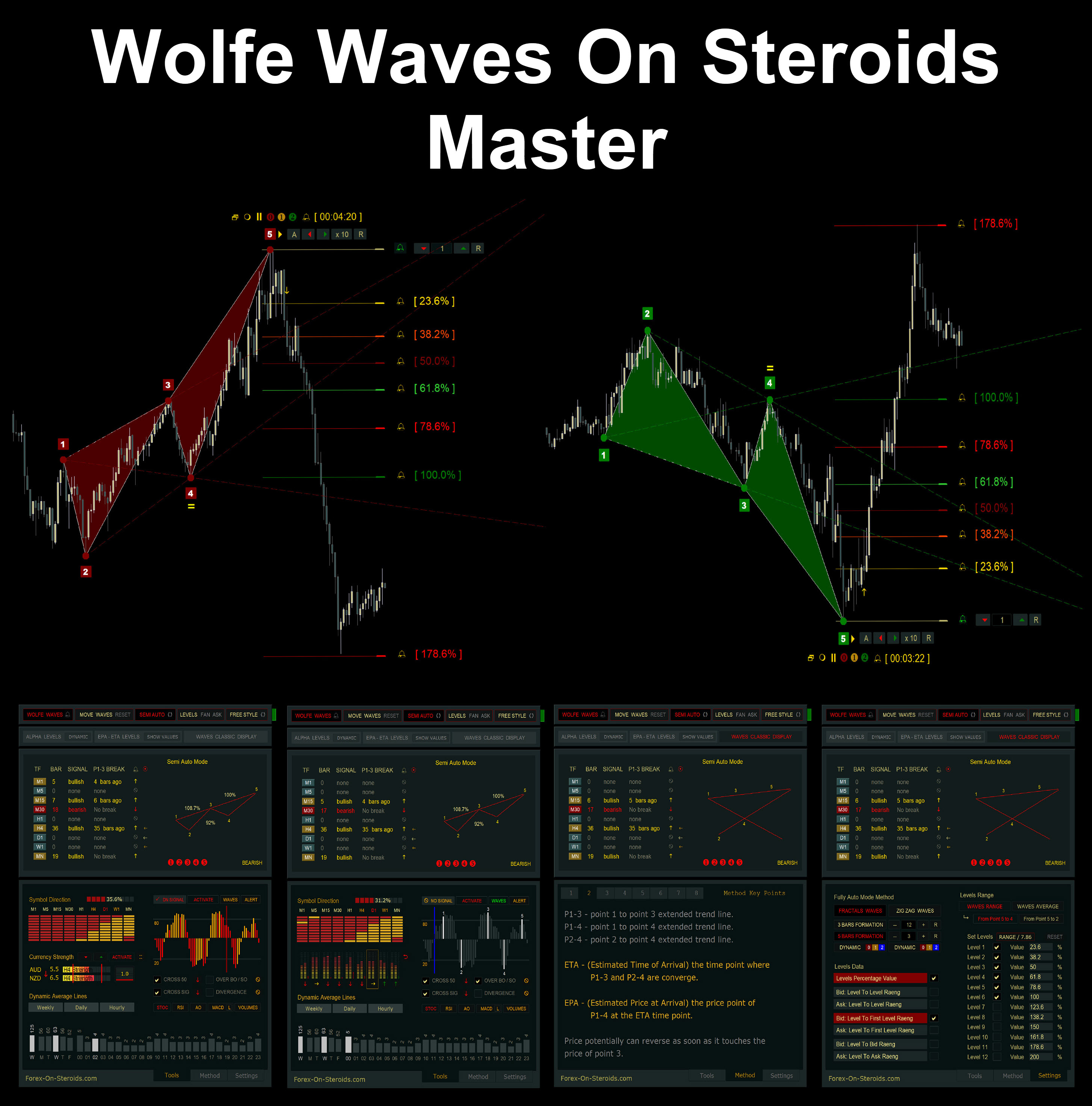

Bullish Wolfe Waves pattern

A bullish Wolfe waves pattern, in general, looks like this:

To draw it, a double top should emerge, where the second top will be lower than the first one (point 4 is lower than point 2)

Here, point 1 is the foundation of the first top (point 2)

Point 3 is the low of the retracement wave after its first top.

Point 4 is the high of the second peak.

Point 5 is the intersection of ray 1-3 (ETA)

The sweet zone is the zone to open long positions, starting from point 5 and below.

ETA – Estimated Time at Arrival, ray 1-3

EPA - Estimated Price at Arrival, ray 1-4

The intersection of ray 2-4 with the ETA line indicates the date when the price will reach the target.

The projection from this point on EPA estimates what is the price target level.

Bearish Wolfe Waves pattern

A bearish pattern looks like a mirror image of a bullish one.

In general, it looks like this:

For its formation, a local double bottom should emerge, where the second bottom will be higher than the first one (point 4 is above point 2).

Here, point 1 is the apex, lower than that at point 3

Point 3 is the retracement wave’s highest point after the first bottom

Point 4 is the second bottom’s low

Point 5 is the point of ray 1-3 intersection (ETA)

Sweet Zone is the zone to open short positions, starting from point 5 and above

ETA – Estimated Time at Arrival, ray 1-3

EPA - Estimated Price at Arrival, ray 1-4

Studying the Wolfe Waves reverse pattern

The pattern formation has quite a simple structure, however, Bill points out many technical features that should be remembered when drawing the pattern, and you must take them into account in your analysis to adjust the final target or cancel the pattern completely.

1. As a rule, reversal points are accompanied, first, by the decline in trading volume and then its increase, by the pattern completion. In the chart, the volume looks like a saucer.

With a more detailed study of the bullish Wolfe waves in the chart below, these volume swings are marked by red arcs.

2. Trendline breakdown is a perfect situation for Wolfe Wave to emerge. The market’s nature itself supports the waves formation.

Any action causes a reaction, and so, any rupture of the trendline will result in an attempt to draw the price back, to the former levels.

3. Bill strongly suggests eliminating all unnecessary elements from the chart when you are looking for a Wolfe Wave pattern, to keep your attention focused. The only indicator he allows is the volume indicator.

4. Waves in the longer timeframe are canceled by the waves in the shorter one.

For example, you are inside a bullish Wolfe Wave in the daily chart and moving your position along arrow 1-4 up toward the suggested target. But, if there is a bearish Wolfe wave in 12-hour chart, it is a strong signal to fix your profits. Here, what matters is the comparability of scopes. If you are working with a bullish Wolfe wave in the daily timeframe, you needn’t worry about a bearish wave in the 5-minute chart.

5. How to predict reversal waves? You need to analyze the line segment between points 4 and 5. Each sub-wave here creates the corresponding support and resistance levels. They should be taken into account when you enter a trade in the sweet zone with a target at ray 1-4. These marked structures are highly likely to create similar sub-waves on the price way to the target

6. How to find point 4?

You need to know where points 1, 2, and 3 are.

You draw a ray from point 2, parallel to ray 1-3. Now, you understand that point 4 should be below this line, otherwise, rays 1-3 and 1-4 won’t converge, and so, the pattern won’t be formed.

Next, you need to follow the trendline; each touching the trend during the return from point 3 is a potential reversal point for wave 4.

Here, I should note that, as a rule, point 4 will be the highest point in five-wave formation (see chart below)

7. How to estimate the depth of the Sweet zone?

Unfortunately, Bill doesn’t suggest any certain ways to predict this wave’s depth. However, he suggests you not worry about this, as any position below point 5 is quite promising. You now only need to have the PATIENCE, he writes about so much.

Nevertheless, there is a way to find out at least its approximate borders. To do it, you need to draw a parallel line from ray 2-4 to point 3.

Ideally, the sweet zone should be bordered by the space between ray 1-3 and this projection

Unfortunately, this method didn’t work in our case.

Another signal here is the ticker volume highs. As clear in the chart above, the highest volume is exactly at the bar that formed the extreme in the sweet zone.

Here, it is very important to follow the rules of money and risk management, to avoid margin call in case of a deep sweet zone.

8. Signs that the price will reach the target at line 1-4:

- Completely formed wave 4-5 with some sub waves

- Volume growth during the reversal in the sweet zone

- Passing through ray 2-4 with a large volume

9. To find point 1, you need to draw a projection of the horizontal line from point 3 toward point 2. The first bar, whose tail (shadow) converges with this line, will identify the needed point.

I want to emphasize once again that Bill Wolfe pays special attention to the converging point of rays 1-3 and 2-4, which allows finding out the estimated date, when the price is to reach the target.

There are a lot of resources that describe the Wolfe Waves pattern and its application, but this feature is often forgotten. However, that is the main advantage of the indicator, it enables to predict the targets in time.

Besides, the property of rays 1-3 and 2-4 intersection is quite a good filter, which helps one not confuse every double top or double bottom pattern with Wolfe’s five-wave formation.

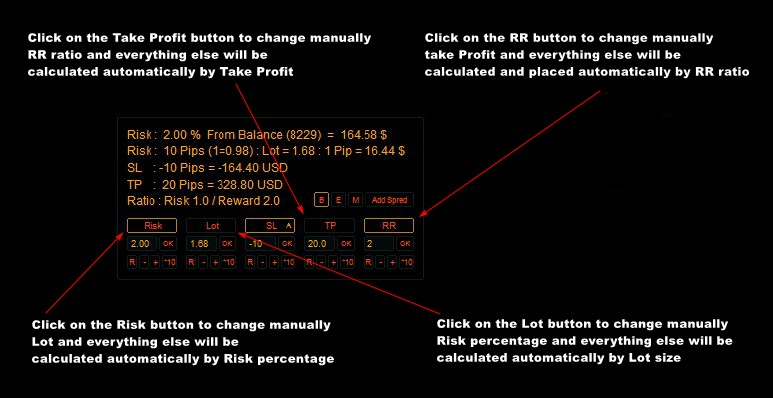

Forex trading strategy with Wolfe Waves

For entry, you can use the sweet zone described by the author. It is built by transferring line 2-4 to point 3. The resulting triangle is a place for the creativity of traders. A position can be opened at the time of the return of quotations within the limits of the traded pattern. In the example the buy order is set at the resistance breakout level in the form of line 1-3, the stop order is placed at the bar's low at point 5. It should not be forgotten that for the tests, the protective stop orders are narrow, and the entry into the position can be made several times in succession as the stop signal is worked out.

Trading on peaks involves additional signals confirming the reversal. This can be the Head and Shoulders pattern (or any other countertrend trading pattern), or the break of trend lines acting as diagonal support or resistance levels. The exit of the quotations of the currency pair outside the trading channel is in itself a serious signal, and coupled with the Wolfe Waves pattern it is a good reason for the formation of positions. The protective stop order in the first case (combination of patterns) is placed below the bar low at point 5, in the second (combination of the pattern and trend lines) - in the correctional low area.

The classical approach provides for an exit from the transaction as the quotations of the currency pair reach the line 1-4. At the same time, a perpendicular projection drawn to wave 1-4 from point 5 can be used. It will give you an intermediate target, which is achieved much more often than the previous target benchmark. Using the projection allows you to customize the process of controlling the position. For example, as it is reached, a trader can:

- close the position completely,

- move the protective stop order to the breakeven point,

- take a part of the profit and move the protective stop order to the breakeven point.

The Wolfe Wave can easily be called the secret king of chart patterns. Many criteria are necessary for its formation, but they harmonize excellently with each other. Once the five points and three lines have been discovered, one can look forward to a trade with a good risk-reward ratio and precisely defined stop and target.

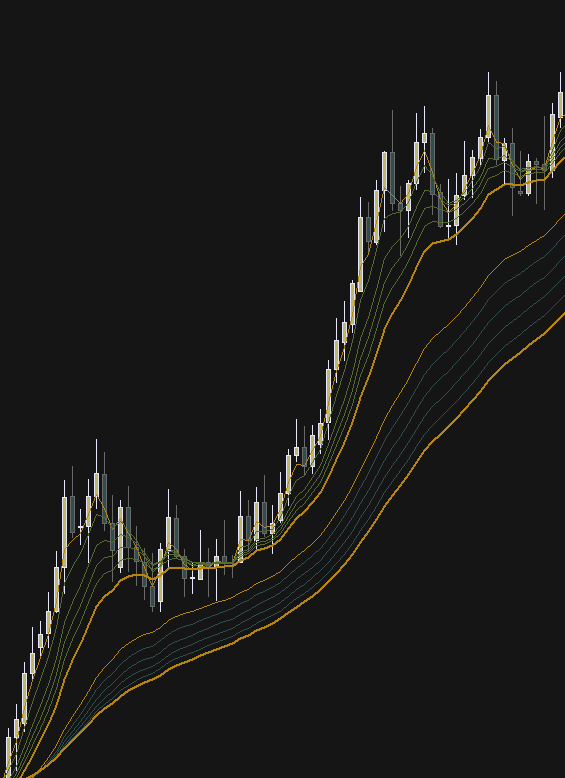

Forex On $teroids

Forex On $teroids