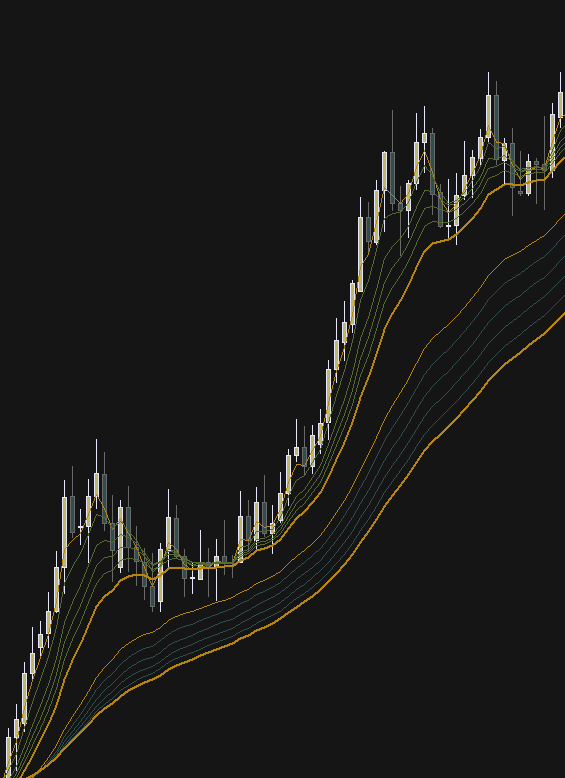

Ascending Trend Line

An ascending trend line is a chart pattern containing two or more higher lows that can be connected with a straight line.

It is a bullish pattern created by connecting two or more lows, with each successive low higher than the previous low.

This creates an upward-sloping trend line

An ascending trend line is also known as an “uptrend line“.

Since technical analysis is built on the assumption that prices trend, the use of trend lines is important for both identifying and confirming trends.

An ascending trend line acts as support and indicates that demand (more buyers than sellers) is increasing even as the price rises.

A rising price combined with increasing demand is very bullish and shows really strong buying pressure.

As long as the price action stays above this line, it is a bullish trend.

Price can bounce as the trend line acts as support.

Price usually retests a sloped trend line several times, until it breaks at which point we may have a trend reversal.

The more points there are to connect, the stronger a trend line becomes.

The strength of the trend line is also determined by how many market participants recognize the trend line.

If a lot of the market acknowledges the same trend line that you see, then the trend line becomes self-fulfilling.

As long as prices remain above the trend line, the uptrend is considered solid and intact.

A break below the ascending trend line indicates that buyer demand has weakened and a change in trend could be imminent.

If the price breaks through the ascending trend line, you can short the breakdown but be aware of fakeouts (false breakouts) though.

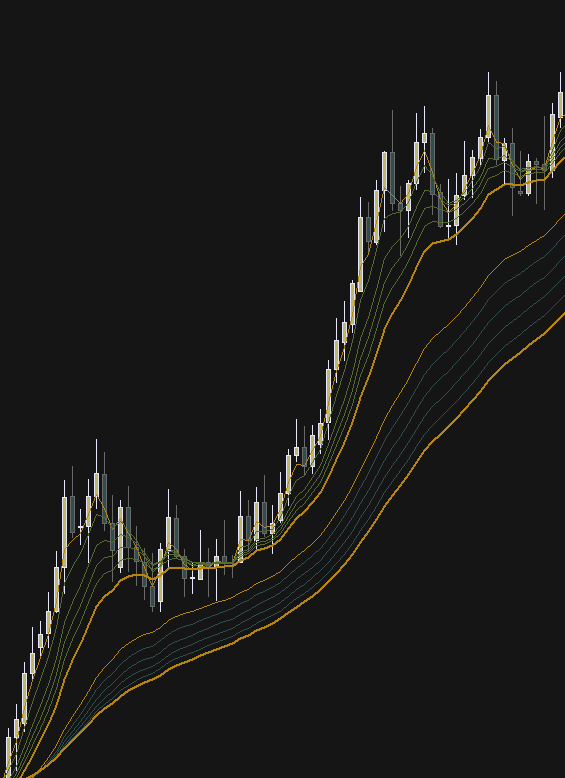

Descending Trend Line

A descending trend line is a chart pattern containing two or more lower highs that can be connected with a straight line that has a negative slope.

It is a bearish pattern created by connecting two or more highs, with each successive high lower than the previous low.

This creates a downward-sloping trend line

A descending trend line is also known as a “downtrend line“.

Since technical analysis is built on the assumption that prices trend, the use of trend lines is important for both identifying and confirming trends.

A descending trend line acts as resistance and indicates that supply (more sellers than buyers) is increasing even as the price falls.

A falling price combined with increasing supply is very bearish and shows really strong selling pressure.

As long as the price action stays below this line, it is a bearish trend.

Price can pullback as the trend line acts as resistance.

Price usually retests a sloped trend line several times, until it breaks at which point we may have a trend reversal.

The more points there are to connect, the stronger a trend line becomes.

The strength of the trend line is also determined by how many market participants recognize the trend line.

If a lot of the market acknowledges the same trend line that you see, then the trend line becomes self-fulfilling.

As long as prices remain below the trend line, the downtrend is considered solid and intact.

A break above the descending trend line indicates that buyer demand has increased and a change in trend could be imminent.

If the price breaks through the descending trend line, you can go long the breakout but be aware of fakeouts (false breakouts) though.

How do you draw trend lines?

To draw forex trend lines properly, all you have to do is locate two major tops or bottoms and connect them.

Types of Trends

There are three types of trends:

- Uptrend (higher lows)

- Downtrend (lower highs)

- Sideways trend (ranging)

Here are some important things to remember using trend lines in forex trading:

It takes at least two tops or bottoms to draw a valid trend line but it takes THREE to confirm a trend line.

The STEEPER the trend line you draw, the less reliable it is going to be and the more likely it will break.

Like horizontal support and resistance levels, trend lines become stronger the more times they are tested.

And most importantly, DO NOT EVER draw trend lines by forcing them to fit the market. If they do not fit right, then that trend line isn’t a valid one!

Forex On $teroids

Forex On $teroids